End of tax year checklist

Guide payroll admins through the tasks to complete their payroll year end and get ready for the new year

Opportunity

Payroll admins have a series of tasks and checks they need to complete to make sure they are compliant and in a good position for the new tax year. We saw an opportunity to makes the end of year process more explanatory and efficient by bringing the workflow into our product instead of navigating our customers to a blog or brochure.

Result

The checklist improved the year end experience for hundreds of payroll admins resulting in a 10% increase of self reported satisfaction with the year end process. There was also a reduction in customer support tickets related to setting up the new year correctly.

Role

Lead designer

Big thanks to

Product owner

Lead engineer

Researcher

AB designers

Mobile design specialist

Customer journey mapping to understand compliance

To understand the customer ‘jobs to be done’ to complete HMRC’s end of tax year’s requirements, I worked with our BA and compliance officer to put together a journey map synthesised from desk research, competitor evaluations, heuristic evaluation of our own product, and customer calls. The resulting journey map helped unify the cross functional team’s understanding and alignment on the core opportunities.

Ensuring the design is scalable and reusable

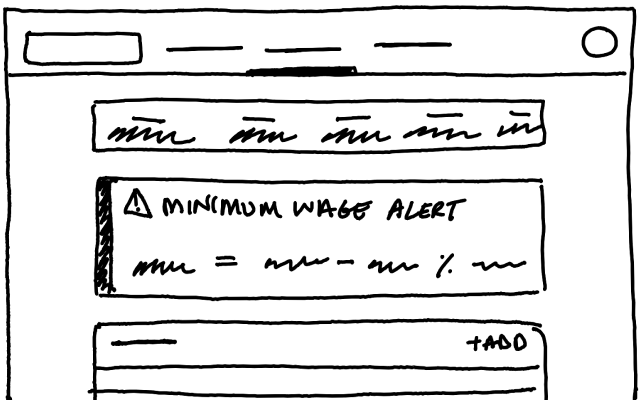

From the journey map, it became apparent that each customer’s journey was going to look slightly different specific to their business. In the time we were to deliver, we would not be able to confidently create a list of tasks specific to the business, but we could create a list of tasks that most payroll admins would need to complete. Early sketches prioritised the design of this solution to be scalable to the different tasks and reusable for similar scenarios such as running your first pay run.

Early feedback on tax code updates

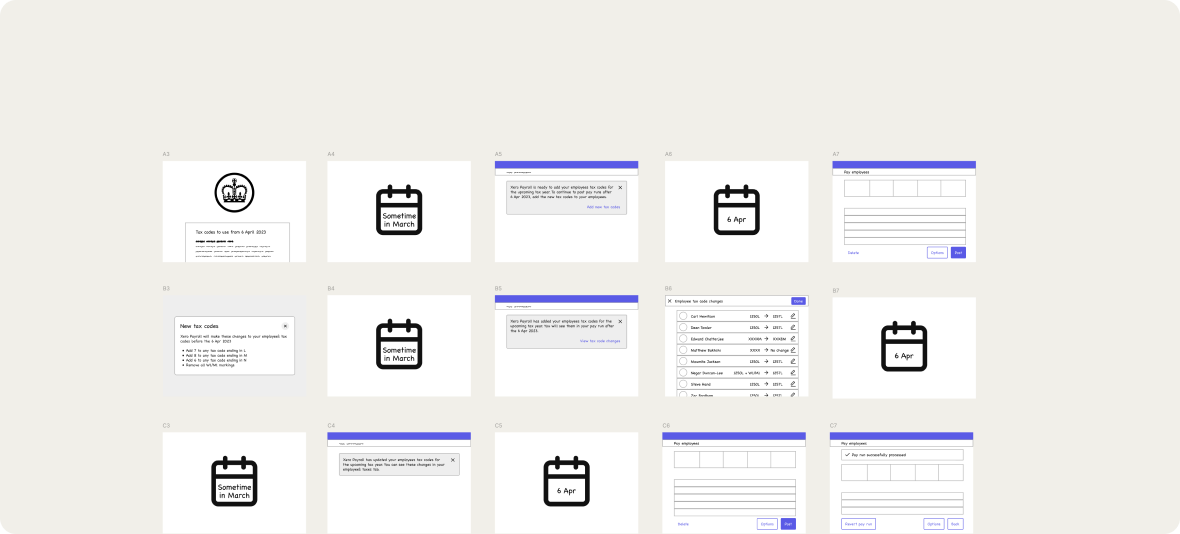

An opportunity identified to reduce tasks for the payroll admin at year end, was to automatically update the tax codes as per the instructions from HMRC. Because of an arbitrary time HMRC would send the letter, we needed to be sure of our sequence of when to automatically update the tax codes. I ran a quick concept test using the ideas generated from our experts of when to notify and then update the tax codes. The results made sure we didn’t update too early nor too late and kept the payroll admin informed the entire time.

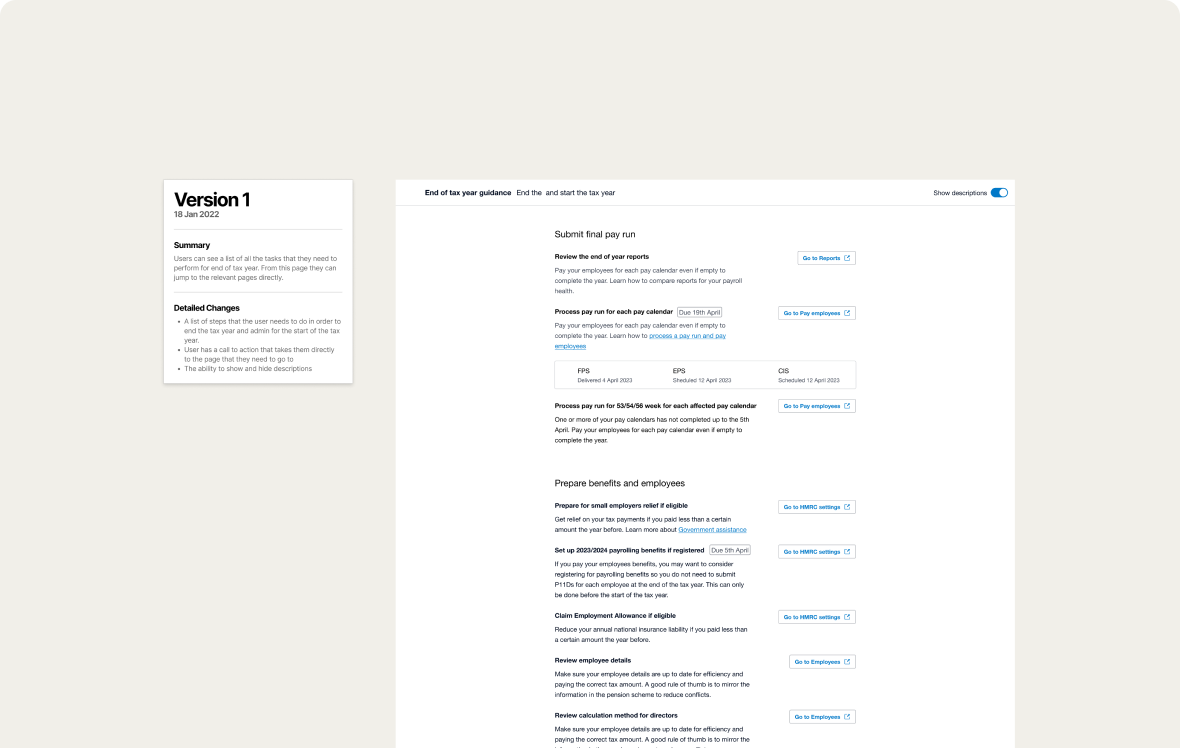

Driving incremental value through phased releases

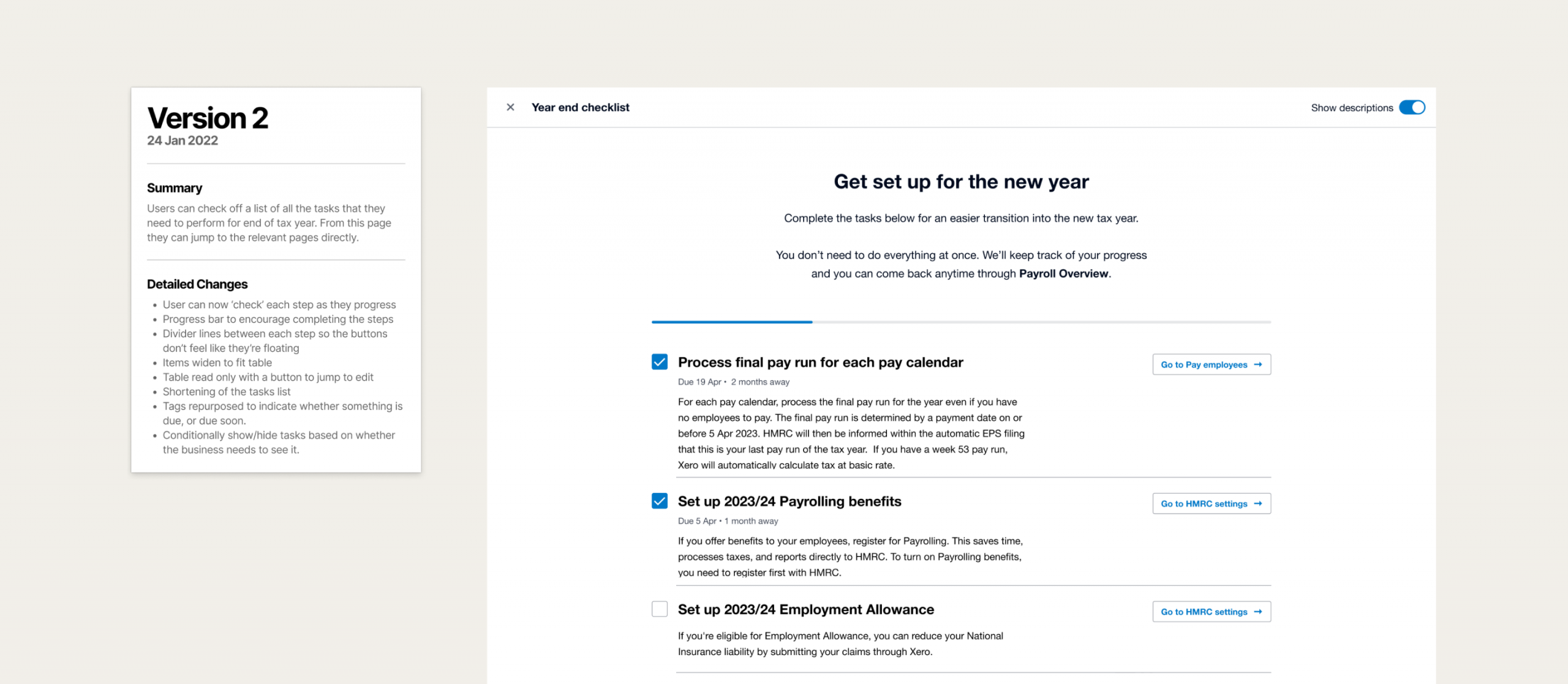

Working with my team in an agile environment, I designed in phases with their feedback. The first iteration was a static list with a description of what to do, with a link to go directly there to do the task. While providing a small amount of value to our customers, we had something we could deliver in time for the new tax year. It also made it easier for me to get feedback from content design and the compliance officer with minimal distraction.

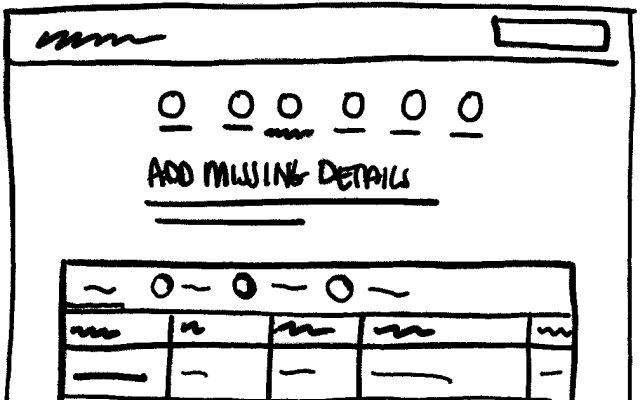

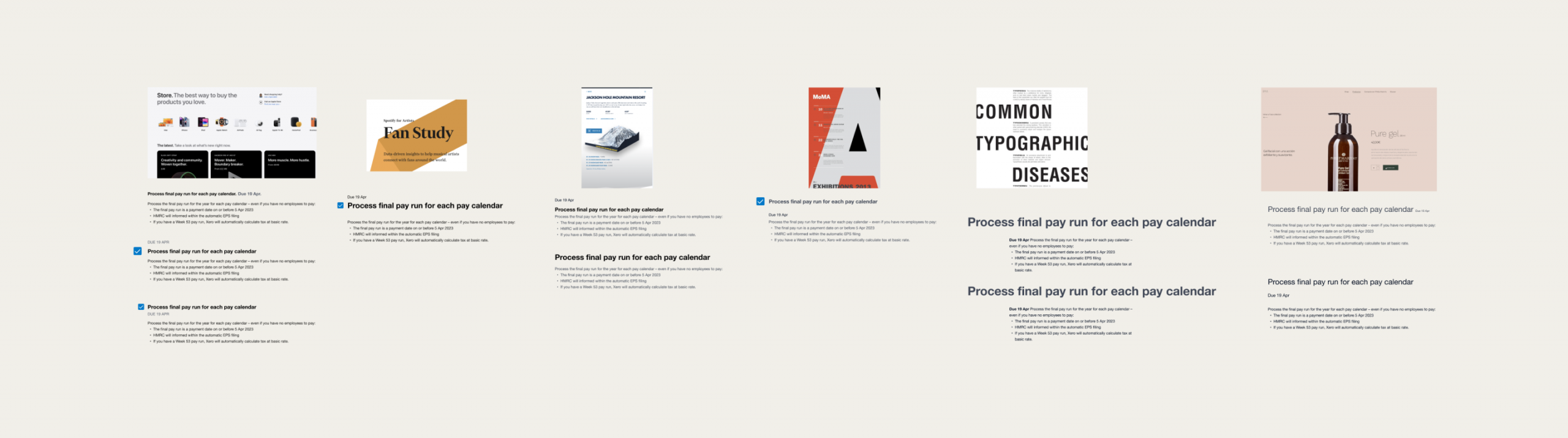

Improving the hierarchy

I felt that the visual hierarchy of the first iteration made it difficult to immediately identify what the task to do was. To explore other variations, I took inspiration from other websites to imitate their style and reflect whether it improved my own design and why I felt that way. The result was then adapted to match the design system.

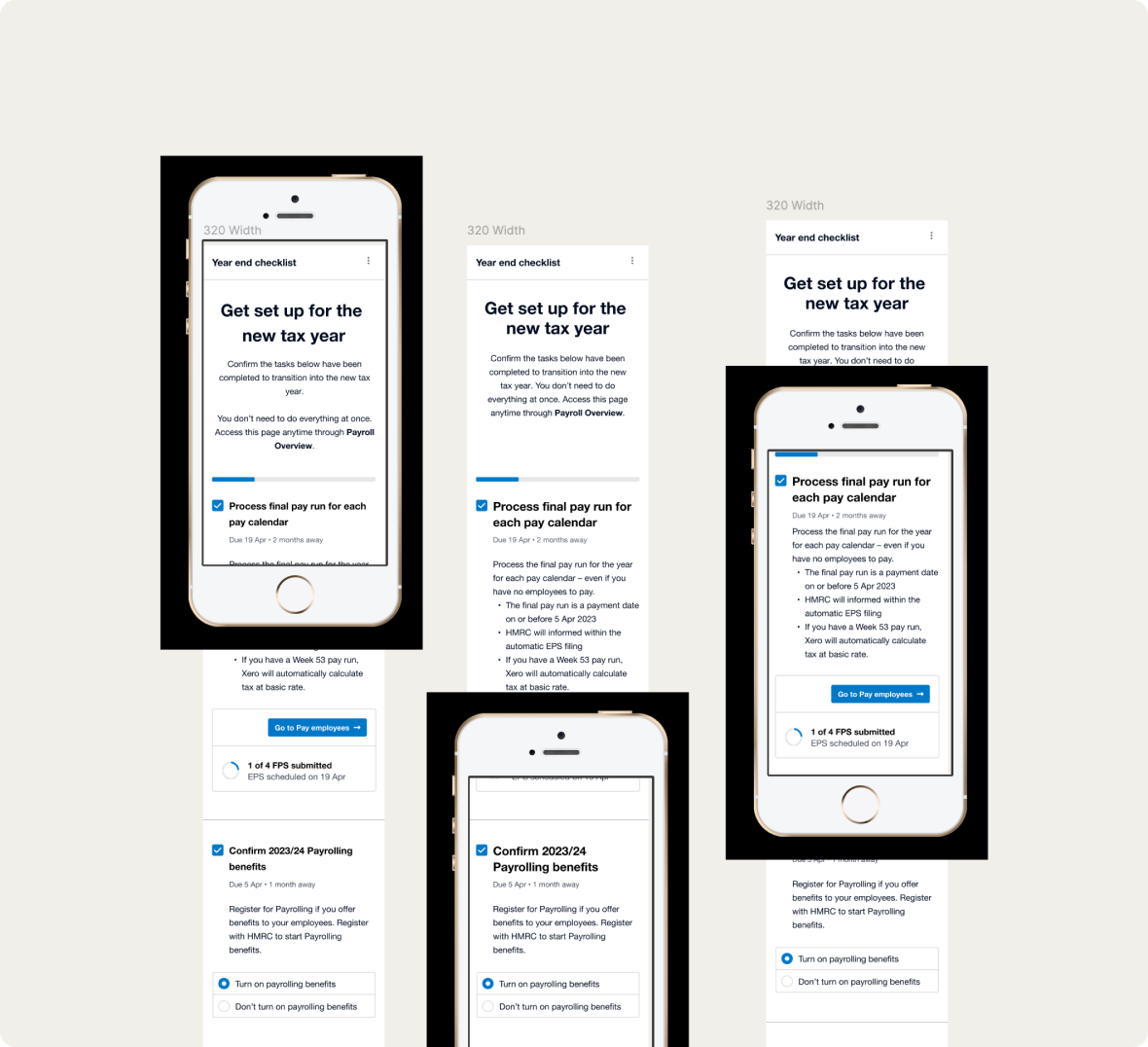

Ensuring the components work across devices

Similar to paper prototyping, I used a cut out mobile phone to view my design at a smaller screen size. This helped me to redesign the checklist at a smaller screen size and give direction to the engineers.

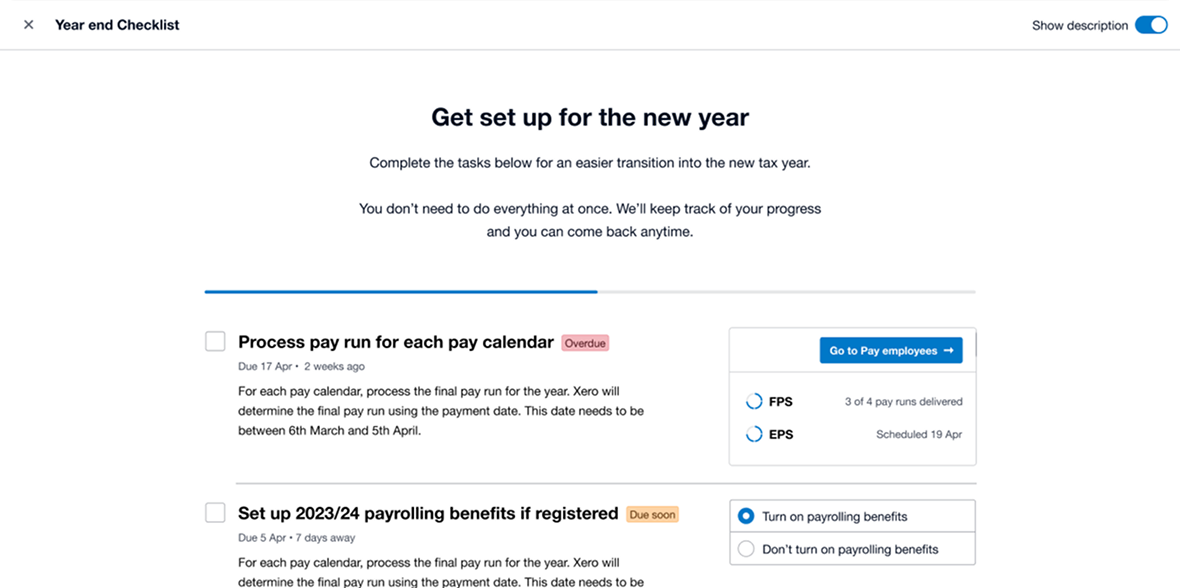

Delivering for the long term business value and reusability in other products

The design that we were able to deliver to payroll admins before the start of the tax year included the ability to check off items, and be taken to the page to make those changes. This checklist was built for reusability in other areas of the payroll product. It was reused the following year to ensure all the steps were complete setting up payroll.

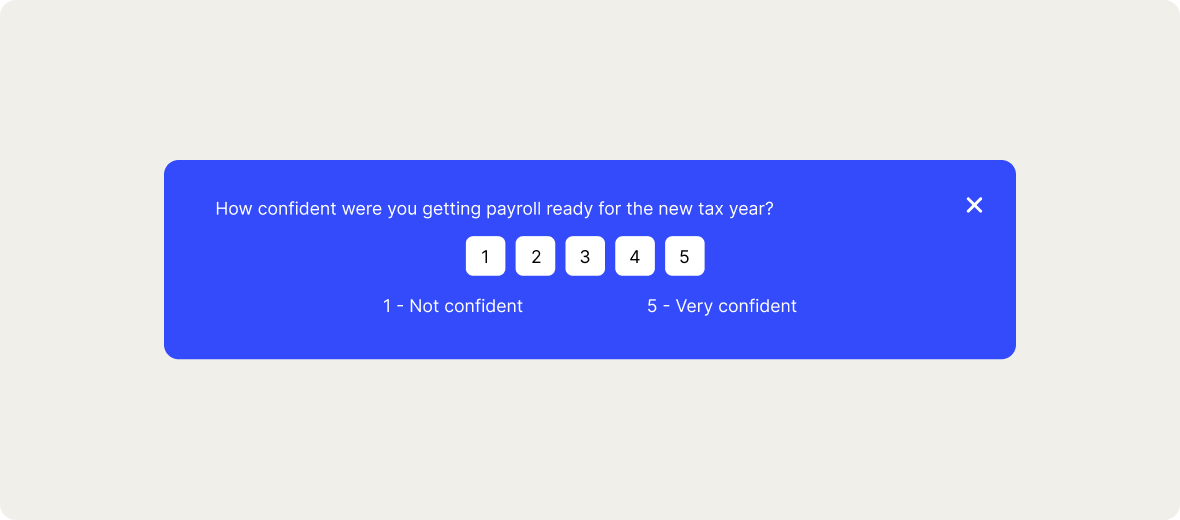

Improvement to the year end experience

Two weeks after the start of the tax year, we published an intercom campaign to get feedback on our customers end of tax year experience. Payroll admins who used the checklist self reported having more confidence completing their year end and a better experience than those who did not. We have since continued to update and improve the year end checklist.

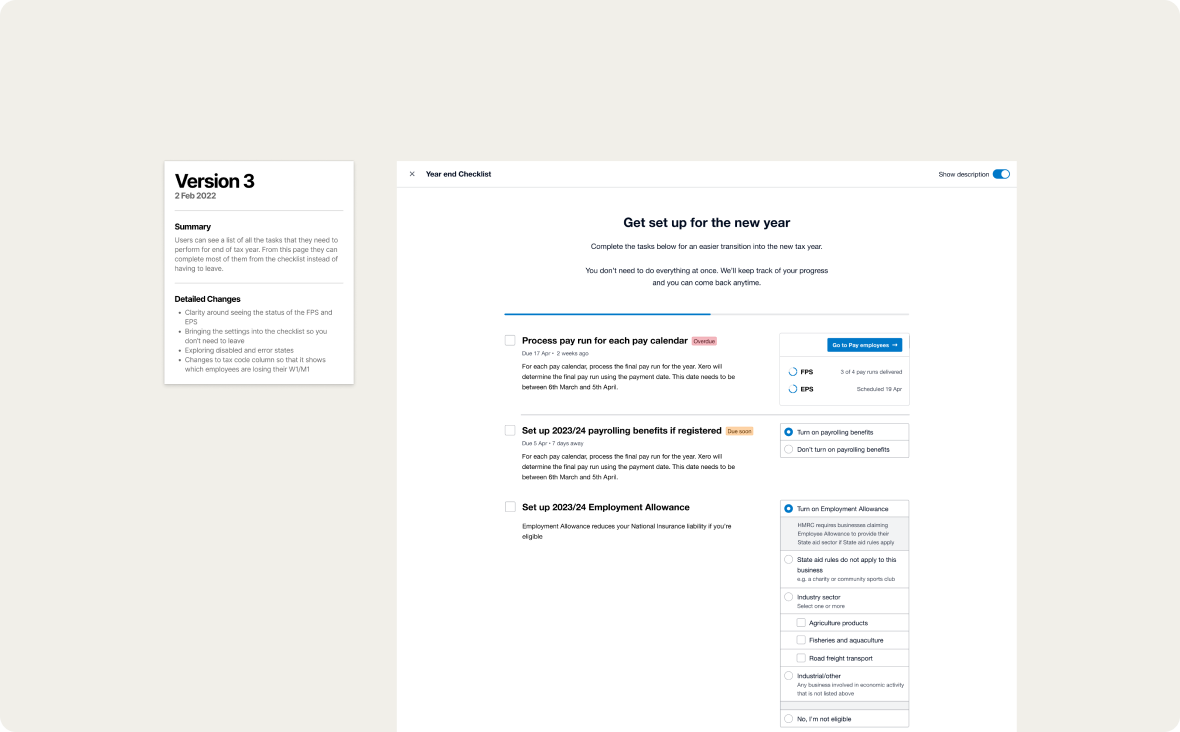

Bringing tasks inside the checklist

Instead of navigating the payroll admin away to other areas of the product, I wanted to bring the choices into the checklist. A spike by the engineers was undertaken to investigate the requirements. We decided that the timing wasn’t right for the level of investment, but the intent to collate tasks together did inspire other future pieces of payroll work.

Other projects

National minimum wage calculation

Supporting employers to confidently pay their employees above national minimum wage

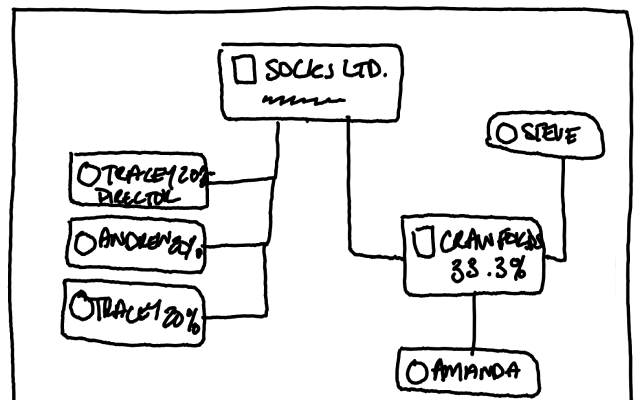

Client connections

Capture the connections between people and organisations for an accurate representations of a client